Are Consumer Lenders Prepared for the Debt Tsunami?

Are Consumer Lenders Prepared for the Debt Tsunami?

A TSUNAMI OF DEBT IS ON THE HORIZON. IF HISTORY IS ABOUT TO REPEAT ITSELF – HOW CAN CONSUMER LENDERS PREPARE FOR THE INCREASE IN DEFAULTS?

- Rising food prices

- Rising energy prices

- Tougher financial conditions

How can the world prevent a global debt typhoon?

Experts suggest:

- Manage borrowing and lending better. Creditors should offer contingency plans to borrowers, like pausing repayments if the borrower faces financial difficulties.

- Introduce better ways to manage surges and crises in low-income countries who are more vulnerable to external crises since a high proportion of their debt is foreign.

- Promote alternatives to borrowing. Lower-income countries face major public financing shortfalls even for basic public needs like health care and education, studies say. If these countries improve tax collection, they can reduce the need for borrowing more.

- Increase accountability and transparency both for borrowers and lenders.

How can consumer lenders in the US prepare themselves for the increase in defaults headed their way?

EverChain has 3 tips to help creditors insulate themselves from the impact:

- Improve the efficiency and effectiveness of your recovery efforts by optimizing when, where, and how long you collect internally, place with agencies (which ones and for how long), and when to eventually sell (at the point of diminishing returns).

- Sell your warehouse of defaulted accounts securely, easily, and compliantly, generating millions and ensuring that your consumers’ experience is the same post-default as it is pre-default.

- Review data on recent defaults and tighten underwriting criteria accordingly.

- Increase accountability and transparency both for borrowers and lenders.

You can read about how EverChain is increasing transparency on their website.

Data sourcedhttps://www.everchain.com/creditors from the following media outlets:

• Gravitas Plus: Which countries could go the Sri Lanka way? By Palki Sharma

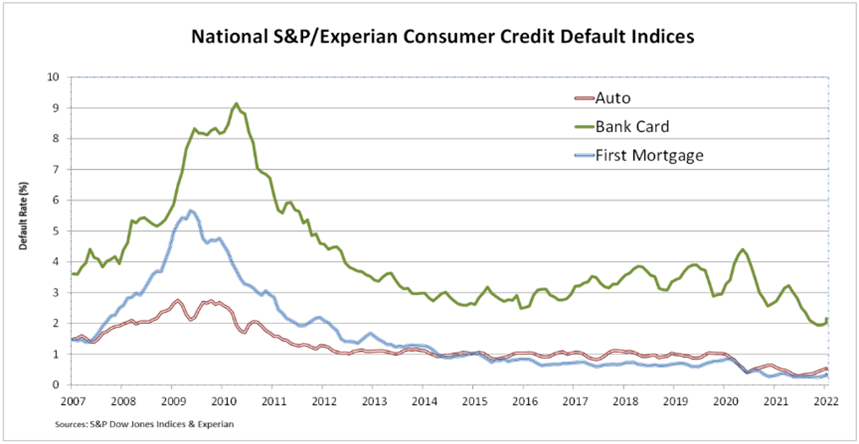

• S&P Dow Jones Indices

• Experian

Send an email to our sales team to learn how EverChain is helping consumer lenders insulate themselves from the impact of the upcoming recession and the resulting increase in defaults.

Related Posts

In today’s competitive financial landscape, creditors face increasing pressure to maximize returns while minimizing operational [...]

Learn Why Creditors Are Selling Charged-Off Debt Recent reports reveal that major U.S. banks like [...]