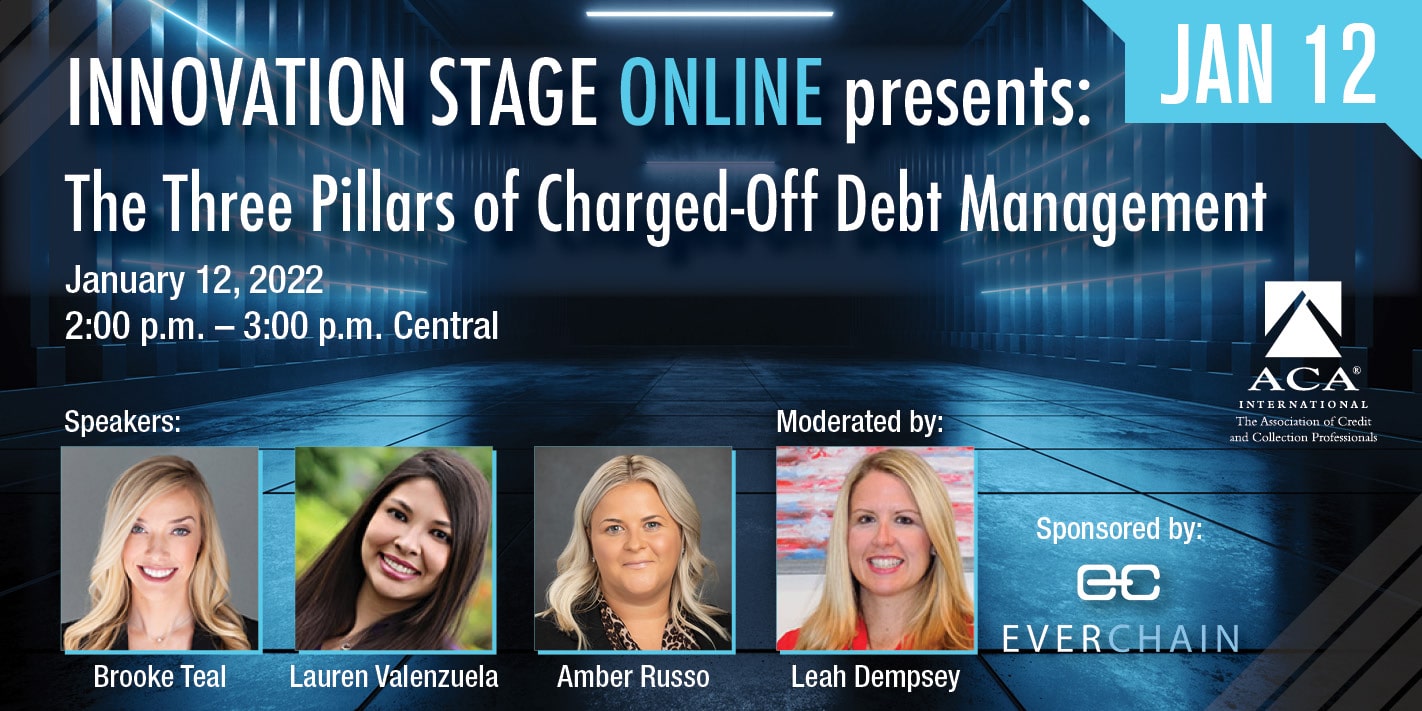

The 3 Pillars of Charged-Off Debt Management

The 3 Pillars of Charged-Off Debt Management

Vice President of Business Development, EverChain

Brooke Teal is the Vice President of Business Development at EverChain. Prior to joining EverChain, Brooke was the Director of Business Development for a nationwide collections network. She was also the Lead Attorney for a creditor’s rights law firm where she represented both original creditors and debt buyers. Brooke previously worked as in-house counsel for two of the top five debt buyers in the nation, focusing on litigation and compliance. Brooke has served as the Florida Creditor’s Bar President, presented at the 2021 ACA International Conference and Expo, and was awarded the “Top 40 under 40” award by the National Trial Lawyers. She is currently licensed to practice law in Florida, Georgia, and Alabama.

Lauren Valenzuela

Counsel, Actuate Law, LLC

Having served as general counsel for many years in the financial services industry, Lauren has a breadth of experience advising on compliance with federal and state consumer protection laws, government regulation and affairs, state licensing requirements, data privacy, litigation defense, labor and employment issues, transactional matters, and business strategy. Lauren is a leader in the accounts receivables industry. She serves on multiple committees for ACA International and is an ACA-certified Credit and Collection Compliance Attorney. She has presented and/or written compliance commentary for InsideARM, ACA International, AccountsRecovery.Net, Receivables Info, and the California Association of Collectors (CAC). She was recognized as a Top 50 Receivables Professional and a Top Women Leader in Accounts Receivable in 2019 by Receivables Advisor.

President, Kino Financial

President of a woman-owned and managed regional debt-buying company based in Arizona. Her responsibilities span all facets of portfolio evaluation and acquisition, agency and legal network management, and business operation. Through her over 15 years in the receivables management space, Amber has participated in more than 150 portfolio purchases. Kino Financial Co., LLC is a Receivables Management Association International Certified Receivables Business. Amber serves the RMAI organization on a handful of committees including Legislative Fundraising, Editorial, and the DE and I task force. She was also recently appointed to the RMAI Certification Council. Amber was awarded last year’s Receivables Management Association International President’s Award for her service to the organization.

Moderator

2022 Vice President and Senior Counsel of Federal Advocacy, ACA International

About EverChain®

EverChain® facilitates compliant and secure debt sales for lenders and other creditors. We enable creditors to manage and monetize their uncollected receivables via our secure, sophisticated, and specialized technology platform (patent pending) consistently and compliantly. We aren’t simply a conventional broker or a buyer; EverChain® is an experienced debt sales advisor who has the expertise to help creditors optimize their recovery strategy while protecting their consumers, brand, and bottom line.

A successful debt sale should not be measured by how much money you sell your accounts for, it should be measured by how much you get to keep. Creditors concerned with any post-sale compliance risk can rest assured that the EverChain® network holds itself to the highest standards of care. This ensures that creditors selling their accounts on the EverChain® marketplace to our certified network of buyers can expect unprecedented and unparalleled levels of compliance from buyers, their agencies, and law firms.

To learn more, book your consultation, or email our dynamic sales team today!

Related Posts

In today’s competitive financial landscape, creditors face increasing pressure to maximize returns while minimizing operational [...]

Learn Why Creditors Are Selling Charged-Off Debt Recent reports reveal that major U.S. banks like [...]