Let’s dive into a topic that touches almost every American: debt. We’re nearing the end of 2023, and the financial landscape has some staggering numbers to digest.

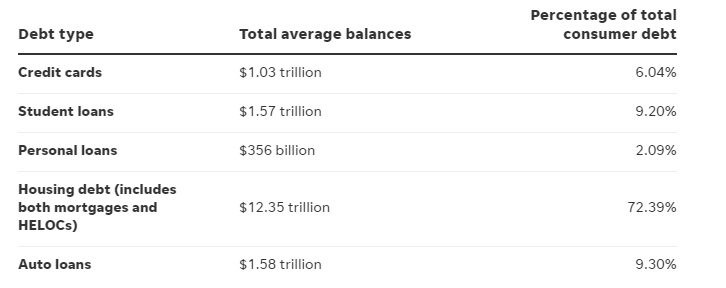

The total household debt in the U.S. soared to a jaw-dropping $17.06 trillion in the second quarter of 2023, with credit card debt alone reaching $1.03 trillion, according to the Federal Reserve Bank of New York. Let’s break down what this means for the average American consumer.

The Many Faces of Consumer Debt in 2023

Consumer debt is a broad term, covering various financial obligations, from credit card debt to mortgages and student loans. Here’s a quick rundown of the types of debt Americans are juggling:

- Credit cards

- Mortgages

- Home equity lines of credit (HELOCs)

- Auto loans

- Student loans

- Medical debt

- Personal loans

According to Experian, the total consumer debt balance increased from $16.38 trillion in 2022 to $17.06 trillion in 2023. This represents a significant 4.15% increase in just one year, driven largely by credit card debt, which jumped by 13.2% from 2021 to 2022. This rise reflects the impact of inflation on the cost of everyday goods.

Unpacking the Average American’s Debt

It’s mind-boggling to think that Americans collectively owe $17.06 trillion in consumer debt. Let’s break it down to understand what it means on a more personal level.

The 2023 Snapshot of Average Household Debt

As of the third quarter of 2022, the average American had about $101,915 in debt. This figure is an average, indicating that while some individuals may owe more, others might owe less.

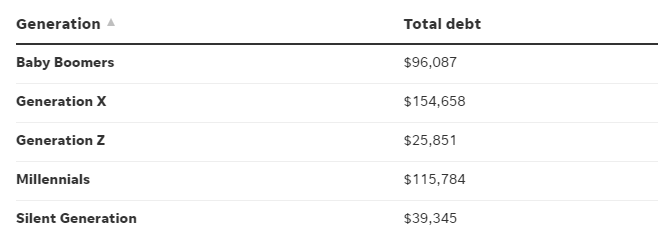

Debt by Age: A 2023 Perspective

Debt varies with age. In the third quarter of 2022, Experian found that Generation X and millennials carried the most debt.

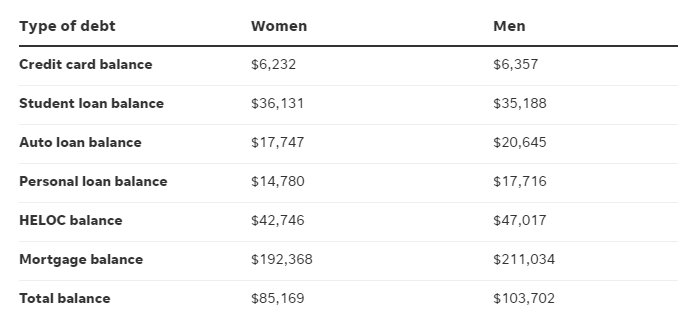

Gender Differences in American Debt in 2023

There’s also a notable difference in debt levels between men and women. Recent statistics, however, don’t include data on non-binary Americans. Generally, women tend to have less debt than men, except in the category of student loans.

Breaking Down American Debt

Let’s look at how this debt is distributed across different categories, according to the Federal Reserve Bank of New York and the Federal Reserve Board:

The Specifics of Debt Types

- Credit Card Debt: The average American adult had $5,910 in credit card debt in 2022. With high interest rates often exceeding 20% APR, these debts can quickly balloon.

- Student Loan Debt: In 2023, the average federal student loan debt was $37,338, and private student loan debt averaged $54,921.

- Personal Loan Debt: As of 2022, the average personal loan debt per consumer was $18,255, a 7% increase from 2021.

- Mortgage Debt: The average mortgage debt balance stood at $236,443, and for HELOCs, it was $41,045.

- Auto Loan Debt: The average auto loan debt per consumer was $22,612 in 2022, a 7.7% increase from the previous year.

- Other types of debt, like medical debt, are also prevalent. A 2022 KFF report found that nearly 9% of U.S. adults had some form of medical debt.

It’s evident that the landscape of U.S. debt is both complex and challenging. These statistics aren’t just numbers; they represent the real financial struggles faced by millions of Americans. At EverChain, we shared this detailed look into the current state of debt to highlight the critical need for effective and ethical management of Non-Performing Loans (NPLs). Our goal is to offer creditors comprehensive strategies that not only address the immediate challenges of debt recovery but do so in a way that is compliant, secure, and respectful of all parties involved. By understanding the depth and breadth of the debt situation, we’re better equipped to provide solutions that not only benefit creditors but also contribute to a more stable and fair financial ecosystem.

For more on the subject of consumer debt in America, check out this USA Today article. Or watch EverChain’s recent webinar on the State of the Debt Sales Market with a macroeconomic update from TransUnion.

About EverChain®

At EverChain, we’re committed to facilitating secure and compliant debt sales. We provide end-to-end compliance management of buyers and their recovery service providers. Our platform and expertise help creditors optimize their recovery strategy, ensuring the protection of their consumers, brand, and bottom line.

Curious to learn more? Check out our articles and webinars on the EverChain blog. Interested in a free demonstration to turn non-performing loans into income? Schedule a meeting with our dynamic sales team today.